Mobilizing inventory turnover as part of your everyday retail management practices doesn’t have to be mind-boggling. If the thought of endless calculations is already giving you a headache, you can relax. And lastly, you’ll be able to anticipate order-demand with greater accuracy, enabling you to attend to manufacturing and production decisions ahead of time.

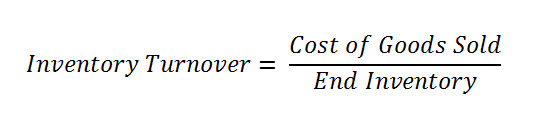

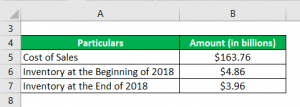

You’ll understand which units are underperforming, and so be able to come up with strategies to solve that-for example, by reviewing their price, discounting them and so on. Why? You’ll know exactly what items need to be ordered or reordered. Understanding your company’s inventory turnover will also help you make better, smarter business decisions all around. Businesses with high inventory turnover enjoy reduced holding costs and can respond with far greater agility to evolving customer demands. This key performance indicator (KPI) is one of the single most important retail growth indicators as increasing your inventory turnover drives profit. Understanding your inventory turnover is a one-way ticket to increased profitability. Understanding inventory turnover ratios will help you increase profitability and make better business decisions in the long term. So, instead of leaving order volumes down to pure guesswork, retailers can seek to optimize their inventory turnover rates. Likewise, no retailer wants to underestimate consumer demand. No retailer wants to waste money and resources on unnecessary storage costs. Understanding this central metric is the key to optimizing your resources once and for all. And your inventory turnover ratio is a key indicator of just this. Why is it so important we understand our inventory turnover? For retailers, especially those with multiple retail channels, optimizing inventory volumes in accordance with consumer demand is absolutely imperative, both in terms of profitability and operational efficiency. That means you’ll be able to make better business decisions when it comes to purchasing quantities, manufacturing choices, pricing, and even your marketing methods. This figure is important because it allows businesses to frame their financial footsteps.įor example, by dividing your average monthly, quarterly, or yearly inventory balance by the number of days in that time period, you’ll be able to calculate how long it will take to see your inventory. It shows how many times your business has sold (and replaced) inventory during a given period of time. In essence, inventory turnover is your average yearly inventory. In most typical cases, slow turnover ratios indicate weak sales (and possible excess inventory ), while faster turnover ratios indicate strong sales (and a possible inventory shortage). In other words, inventory turnover measures how fast a company sells. Inventory turnover is the measurement of the number of times a business’s inventory is sold throughout a month, a quarter, or (most commonly) a year of trading. Whichever name you use, the fact is that inventory turnover is a central inventory-management benchmark for omnichannel retailers. Inventory turnover goes by a few names: inventory turn, stock turnover, or simply ‘stock turn’.

0 kommentar(er)

0 kommentar(er)